Are you curious about the world of algorithmic options trading? If so, you’re not alone. The methodology is making waves in the day trading world, and for good reason. Algorithmic options trading essentially automates the trading process using python, meaning that it involves a data science-focused approach to making smart trading decisions. Analysts and traders alike are moving towards algorithmic options trading for many reasons– however, it’s vital to understand how to code in python and how to develop trading algorithms to get any success out of this trading process.

In this guide, we’ll break down the basics of how to automate options trading using python and algorithmic trading strategies. We’ll also break down our algorithmic trading course, so you can learn everything you need to know about algorithmic options trading. You might even be surprised by how quickly you’ll be able to grasp coding in python and building algorithms!

How to Use Python to Automate Options Trading

What is Algorithmic Options Trading?

Algorithmic trading, also known as algo trading, is an options trading methodology that involves using software (algorithms) for the purpose of following very specific instructions to place a trade. The trade that’s placed through algorithmic trading can generate money quickly and with a higher frequency than a human trader could dream of.

In algorithmic options trading, the instructions that an algorithm follows include a ton of different things, from timing to quantity to other mathematical models. There are so many profit opportunities for algorithmic options traders. Since algo trading removes the potential for human emotions to get in the way of smart decisions, the market becomes more systematic.

Let’s consider some different algo options trading criteria for some context. The following instructions can be programmed into the algorithm to ensure that shares are being bought and sold automatically when they reach specific values:

- Purchase 100 shares of a stock when its 100-day moving average tops its 150-day moving average.

- Sell those shares when the 100-day moving average dips below the 150-day moving average.

Some of the most successful hedge funds out there use algorithms. For example, Renaissance Technologies has over $110 billion in assets, Two Sigma has about $60 billion in assets, and Bridgewater has about $138 billion in assets. Clearly, algorithms can do a lot when it comes to accruing wealth, and part of how algorithms can benefit traders is through algorithmic options trading.

We want to trade options use algorithms because, to put it simply, options are complicated and complex. Why not opt for a method of trading in which all of the complicated math is done for you automatically? Algorithmic options trading makes it possible to trade when you’re away from your computer, so you’re not slouched over, slaving away like a traditional day trader.

There are even more benefits to algorithmic options trading. This process makes it possible to backtest your strategies for the most accurate results. It also takes the emotional side of trading out of the equation, which can make a huge difference in successful trades, if you think about it. It’s far too easy to panic or get excited, thus paving the way for lots of human error. Algorithm options trading automates the trade process, so there’s no option to make mistakes. Just as well, options trading using python makes it possible to implement several strategies at a time, thus diversifying your strategies for more success.

In summary, some of the benefits of algorithmic options trading are:

- Algo options trading is less emotional since computers are making the decisions. Emotions are known to cause problems for traders.

- Algorithms are very good at doing complex math (like that required with options) much faster than a human could.

- Algos can trade 24/7, so even if you’re in a meeting or watching a movie, the algorithm can be making winning trades for you.

- Option algos can allow you to trade several strategies/assets at once, which could be too much work for one person to do normally.

Algo Trading Strategy 1: Long Strangle

A strangle is a strategy commonly used in options trading. A strangle involves holding a position in a call and put option with varying strike prices, but with the exact same expiration date and asset behind them. This strategy is smart if the underlying security is likely to endure a significant price movement, but you’re not entirely sure of the direction it will take. If the asset does swing, one could make quite a bit of profit. A strangle can be very easy to program into an algorithm, as well.

Specifically, a long strangle can be very beneficial in algorithmic options trading. With a long strangle, a trader will buy a call and a put option. The profit potential is high because the call option has a limitless upside if the asset rises in price, and the put option can become profitable if the asset falls.

This is what it would look like in a payoff chart:

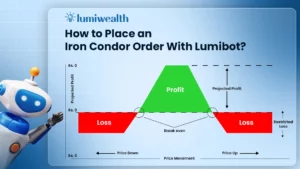

Algo Trading Strategy 2: Bear Call Spread

A bear call spread (aka. A call credit spread) is an options trading strategy that is commonly used in algorithmic trading. With this strategy, one will sell a call option and collect an option premium. At the same time, the trader will purchase another call option with an identical expiration date and higher strike price.

This vertical option spread is beneficial and potentially profitable because the strike of the sold call is lower than the strike of the call that was purchased. The option premium one collects in the sold call will always be higher than the cost paid for the purchased call. This requires quite a bit of research and monitoring normally, but algorithmic options trading can automate the entire process.

This is what it would look like in a payoff chart:

Learn How to Use Python to Automate Options Trading Fast with Lumiwealth

It’s no secret that the world of market trading is changing, and it’s changing fast. More and more traders are starting to invest their time and money into new technology that makes the art of trading much easier and more efficient. One way that traders are doing this is by studying data science and using python to automate their options trading strategies. With this in mind, Lumiwealth is offering algorithmic trading and options trading with python courses to help experienced and new traders alike take full advantage of data science methodologies. At Lumiwealth, our goal is to contribute to the trading community by launching coding courses and a massive, constantly updated library full of videos and code to help traders grasp the more technical aspects of algorithmic trading and options trading with python.

Our Options Trading Course Plans are split up into three options– Self directed, live classes, and project help/tutoring. Our self-directed plan is ideal for those who are busy and would prefer to learn at their own pace. Our live classes are, naturally, live and allow students to interact with/learn from other students and the instructor live over Zoom. Our project help/tutoring plans include everything from the live/self-directed plans and also give you lots of one on one time with the instructors and access to our team of developers who can write custom code for you. This way you can get personalized help with your portfolio and current project.

All of our courses at Lumiwealth will effectively teach you how to analyze your investments the smart way, make good decisions using proven data, and back-test your strategies. Our experienced instructors will also help you learn how to code with python, how to automate your trades, and the right way to calculate risks more efficiently. You might be surprised by how quickly you’ll start grasping these often complex subjects!

Regardless of your choice for your course plan, you’ll be able to view and access hours of videos that are continuously being updated, a huge library of code, and access to the Lumiwealth Discord community where you can network with and interact with other learners and experienced traders. Take a look at our Algorithmic Options Trading course page to learn more and sign up.