Introduction to Automated Trading

Automated trading, or algorithmic trading, has become increasingly popular in recent years. It involves the use of computer programs and algorithms to automatically execute trades on various financial markets. By automating the trading process, traders can save time, reduce human error, and ultimately increase their profits. In this blog post, we will discuss the benefits of automated trading and how you can master the art of algo trading to improve your trading performance.

One of the main reasons why automated trading has gained so much traction is the speed and efficiency it offers. Trades can be executed in milliseconds, allowing traders to take advantage of even the smallest market movements. This speed can be particularly beneficial in fast-moving markets, where timing is critical. Additionally, automated trading can help traders to avoid emotional decision-making, as the algorithms are designed to follow a predetermined strategy without being influenced by emotions such as fear or greed.

In the following sections, we will delve deeper into the world of automated trading, exploring the key components of a successful trading system, strategies for building an effective system, and tips for choosing the right automated trader platform. We will also discuss how to test and optimize your trading system, risk management in automated trading, and real-life examples of successful automated trading systems. Finally, we will provide resources for learning more about system trading and embracing the future of trading with automation.

Understanding Trading Systems and Their Benefits

A trading system is a set of rules and algorithms designed to generate trading signals and execute trades in various financial markets. These systems can be based on technical analysis, fundamental analysis, or a combination of both. The primary goal of a trading system is to help traders make more informed decisions and increase their chances of success in the markets.

There are numerous benefits to using a trading system, especially when compared to manual trading. First and foremost, trading systems can help to eliminate the emotional aspect of trading. Since the system follows a predetermined set of rules, it removes the need for traders to make on-the-spot decisions, which can often be clouded by emotions such as fear, greed, and overconfidence. This can lead to more consistent and rational trading decisions.

Another significant benefit of using a trading system is that it can save time and effort. With a well-designed system in place, traders can spend less time monitoring the markets and executing trades, and more time focusing on other aspects of their lives. Additionally, automated trading systems can be set to run 24/7, allowing traders to take advantage of opportunities in the markets even when they are not actively monitoring them. Finally, trading systems can help traders to improve their overall performance, as they can analyze a vast amount of market data and identify trends and patterns that may be difficult for a human to spot.

Key Components of a Successful Automated Trading System

There are several key components that every successful automated trading system should have. These components work together to ensure that the system functions efficiently and effectively, ultimately helping to boost your trading profits.

- A well-defined trading strategy: The foundation of any successful automated trading system is a solid trading strategy. This strategy should be based on a clear set of rules and criteria for entering and exiting trades, as well as determining position sizes and managing risk. A well-defined strategy will help to ensure that your system operates consistently and provides you with reliable trading signals.

- Robust algorithms: The algorithms used in your trading system should be robust and capable of handling a wide range of market conditions. This means that they should be able to adapt to changing market dynamics and continue to generate accurate trading signals even when the markets are volatile or unpredictable.

- Efficient trade execution: In order to capitalize on the trading signals generated by your system, it is essential that your trades are executed quickly and efficiently. This means that your automated trading system should have a reliable connection to the market and be able to execute trades with minimal delays.

- Performance tracking and analysis: In order to continually improve your trading system, it is crucial that you monitor its performance and analyze the results of your trades. This will help you to identify any issues or areas that may need improvement, allowing you to fine-tune your system and optimize its performance.

- Risk management: A successful automated trading system should have a comprehensive risk management strategy in place. This includes setting appropriate stop-loss and take-profit levels, as well as managing position sizes and diversifying your portfolio to spread risk.

Strategies for Building an Effective Trading System

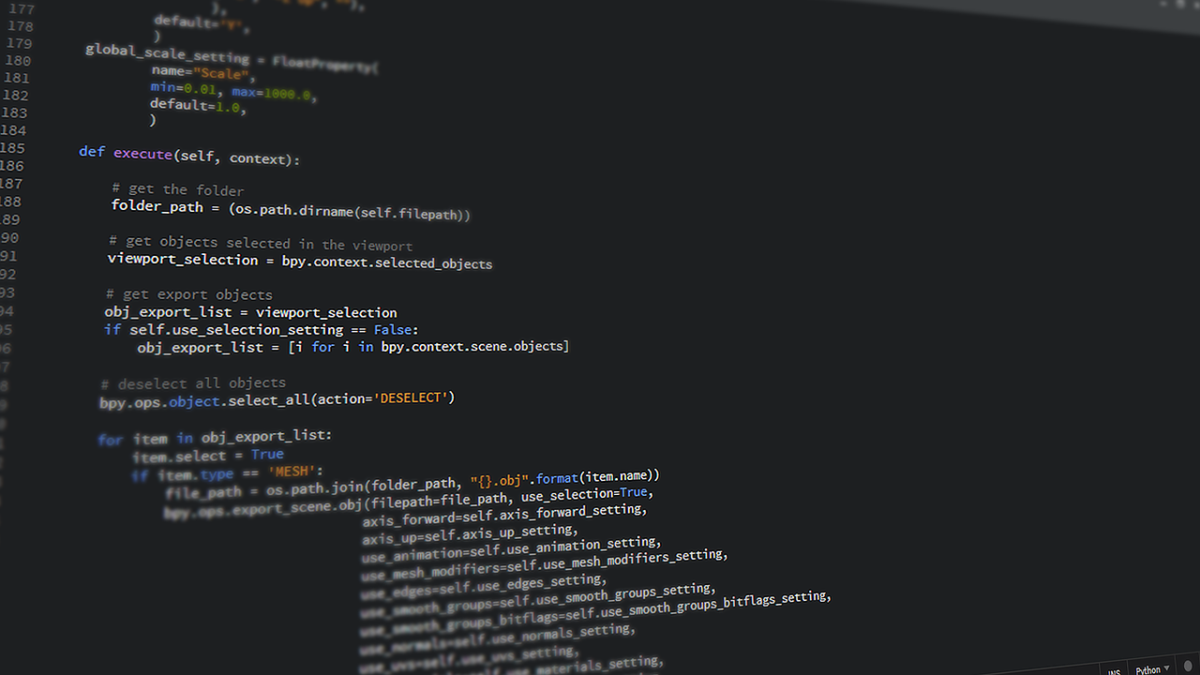

When building an effective automated trading system, there are several strategies that can help to ensure its success. These strategies can be broken down into three main areas: strategy development, system coding, and testing and optimization.

- Strategy development: Before you begin building your trading system, it is important to have a clear understanding of the trading strategy you wish to implement. This will involve researching and analyzing various trading strategies, as well as determining the specific rules and criteria that will guide your system’s trading decisions. It is crucial to take the time to thoroughly research and develop your strategy, as this will ultimately form the foundation of your trading system.

- System coding: Once you have a well-defined trading strategy, the next step is to translate this strategy into a set of algorithms and computer code. This will require knowledge of programming languages, such as Python or C++, as well as an understanding of the technical indicators and trading concepts that will be used in your system. If you are not familiar with programming or trading concepts, you may wish to consult with an experienced programmer or trader to help with this stage of the process.

- Testing and optimization: After your trading system has been coded, it is essential to test its performance using historical market data. This will help you to identify any issues or potential weaknesses in your system and allow you to make any necessary adjustments before deploying it in a live trading environment. During the testing process, it is also important to optimize your system’s parameters, such as its entry and exit criteria and risk management settings, to ensure that it performs at its best.

Tips for Choosing the Right Automated Trader Platform

There are many automated trader platforms available on the market, each offering different features and capabilities. When choosing the right platform for your needs, there are several factors to consider:

- Ease of use: Look for a platform that is user-friendly and easy to navigate, especially if you are new to automated trading. This will help you to get up and running quickly and minimize the learning curve.

- Customization: Choose a platform that offers a high level of customization and flexibility, allowing you to build and modify your trading system to suit your specific needs and preferences.

- Compatibility: Ensure that the platform you choose is compatible with the programming languages and trading concepts you plan to use in your automated trading system.

- Reliability and performance: Opt for a platform that is known for its reliability and performance, as this will be crucial in ensuring that your trades are executed quickly and efficiently.

- Cost: Consider the cost of using the platform, including any subscription fees or commissions, and weigh these against the potential benefits and features it offers.

How to Test and Optimize Your Trading System

Testing and optimizing your trading system is a crucial part of the development process, as it allows you to identify any potential issues or weaknesses and fine-tune your system for optimal performance. There are several steps involved in testing and optimizing your system:

- Backtesting: The first step in testing your trading system is to conduct a backtest using historical market data. This involves running your system’s algorithms and rules against this data to see how it would have performed in the past. By analyzing the results of your backtest, you can identify any areas that may need improvement or adjustment.

- Forward testing: After backtesting your system, the next step is to conduct a forward test, also known as a paper trade. This involves running your system in a simulated trading environment using real-time market data. This will help you to further refine your system and ensure that it performs well in a live trading environment.

- Optimization: During the testing process, it is important to optimize your system’s parameters, such as its entry and exit criteria, stop-loss and take-profit levels, and position sizing settings. This will help to ensure that your system performs at its best and generates the highest possible profits.

- Performance evaluation: Finally, it is essential to continually monitor and evaluate your system’s performance, making adjustments and improvements as needed. This will help to ensure that your system remains effective and profitable over time.

Risk Management in Automated Trading

Risk management is a crucial aspect of any successful trading system, including automated trading systems. By implementing a comprehensive risk management strategy, you can help to protect your trading capital and minimize the impact of losses on your overall performance.

There are several key components of a successful risk management strategy in automated trading:

- Position sizing: Determine the appropriate position size for each trade, based on your risk tolerance and the size of your trading account. This can help to ensure that you do not overexpose yourself to any single trade or market.

- Stop-loss and take-profit levels: Set appropriate stop-loss and take-profit levels for each trade, to help protect your trading capital and lock in profits when they are available.

- Diversification: Diversify your trading portfolio by trading a variety of instruments and markets, in order to spread risk and reduce the impact of any single loss.

- Monitoring and adjusting: Continually monitor your trading system’s performance and make any necessary adjustments to your risk management strategy, in order to ensure that it remains effective and appropriate for your current market conditions and trading goals.

Real-Life Examples of Successful Automated Trading Systems

There are numerous examples of successful automated trading systems that have been developed and used by traders around the world. Some of these systems include:

- Moving Average Crossover: This is a simple yet effective trading system that uses moving averages to generate trading signals. When a short-term moving average crosses above a long-term moving average, a buy signal is generated, and when a short-term moving average crosses below a long-term moving average, a sell signal is generated.

- Turtle Trading System: Developed by Richard Dennis and William Eckhardt in the 1980s, the Turtle Trading System is a trend-following system that uses breakouts and retracements to generate trading signals. The system has been widely used and adapted by traders in various financial markets, including stocks, commodities, and forex.

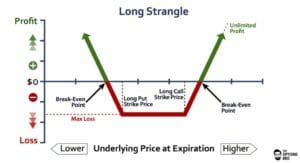

- Pairs Trading: Pairs trading is a market-neutral trading strategy that involves buying one financial instrument and selling a related instrument at the same time. This can help to minimize risk and take advantage of pricing inefficiencies between the two instruments.

These examples demonstrate the potential for success with automated trading systems when they are well-designed, thoroughly tested, and implemented with a comprehensive risk management strategy.

Resources for Learning More About System Trading

If you are interested in learning more about automated trading and system trading, there are numerous resources available to help you develop your skills and knowledge. Some of these resources include:

- Online courses: There are many online courses that offer in-depth instruction on various aspects of automated trading and system trading, including strategy development, programming, and risk management.

- Books: There are countless books available on the topic of automated trading, covering everything from basic concepts and strategies to more advanced techniques and methodologies.

- Forums and discussion groups: Online forums and discussion groups can be an excellent resource for connecting with other traders who are interested in automated trading, sharing ideas and strategies, and learning from the experiences of others.

- Webinars and workshops: Many trading platforms and educational providers offer webinars and workshops on various aspects of automated trading, providing valuable insights and tips for improving your system and boosting your trading profits.

Conclusion: Embracing the Future of Trading with Automation

In conclusion, automated trading offers numerous benefits for traders, including increased efficiency, reduced emotional decision-making, and the potential for improved trading performance. By mastering the art of algo trading and implementing a well-designed, thoroughly tested trading system, you can take advantage of these benefits and ultimately boost your trading profits.

As you embark on your journey into the world of automated trading, be sure to take the time to research and develop a solid trading strategy, choose the right automated trader platform, and implement a comprehensive risk management strategy. By doing so, you can embrace the future of trading with automation and set yourself up for success in the markets.