What Are Crypto Trading Bots?

Crypto Trading Bots are powerful tools for professional traders that want to utilize algorithmic methods in the crypto market. However, they do carry with them a specific risk set!

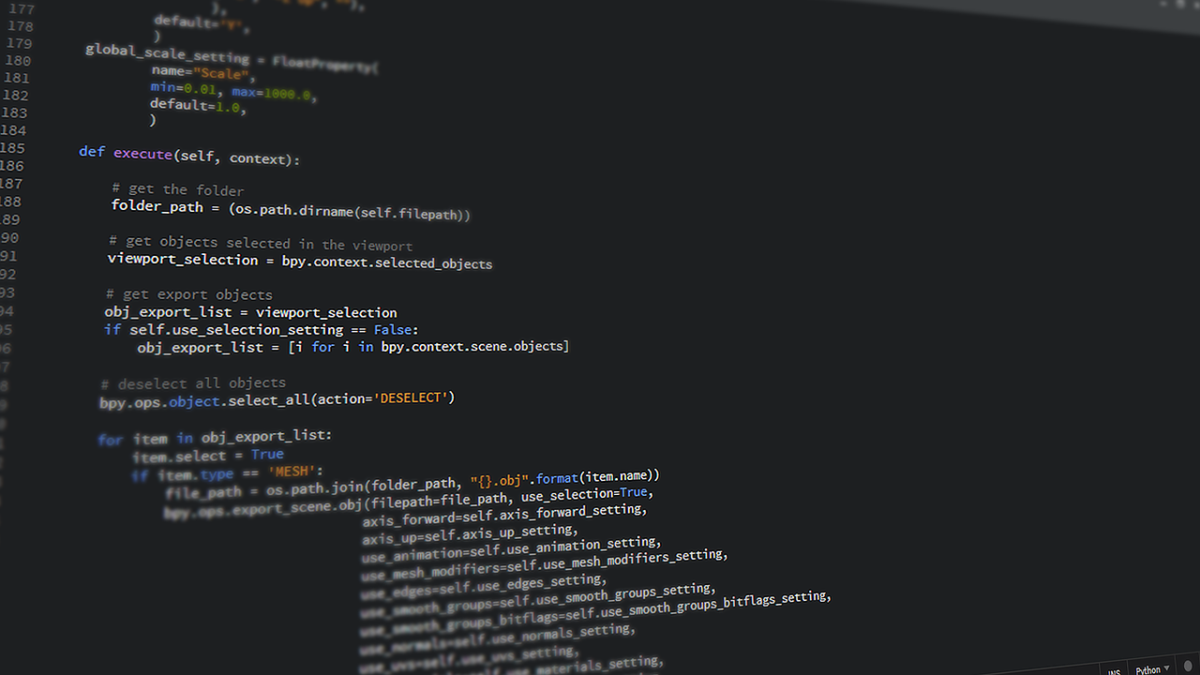

Essentially, these bots are automated software programs that take part in trading in the random cryptocurrency market on behalf of traders. They study the market, recognize trends, and place orders based on pre-established rules. The primary objective is to take advantage of price changes without human intervention.

This automation can reduce traders time and effort while also providing them with the opportunity to capitalize on trading opportunities throughout the clock without having to watch constantly.

How does a crypto trading bot work?

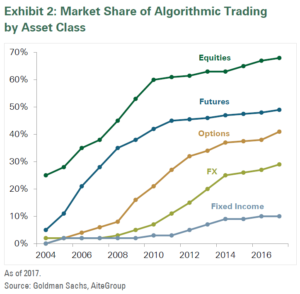

Algorithmic Approaches: Bots utilize a system of limit orders that are placed on both sides of the orderbook in order to make a profit from the spread, they will buy at the lower price and sell at the higher price.

Arbitrage: bots take advantage of price disparities between exchanges, they buy low on one exchange and sell high on another, this is often done in the divided crypto market.

Technical Analysis: Bots utilize historical price information, chart patterns, and average prices to predict future price changes and identify profitable transactions.

Sentiment Analysis: Bots utilize social media sentiment analysis and news to determine the mood of the market, they analyze tweets and articles in order to predict upcoming trends.

API integration:Bots connect to cryptocurrency exchanges via APIs, which provide data in real time, price monitoring, and automated trading. This integration facilitates the rapid decision making and execution of transactions between humans and bots.

Risk Management : Bots facilitate the setting of parameters for risk, such as the maximum and minimum profits that can be attained. This facilitates the avoidance of significant losses and ensures that trades are automatically closed when certain prerequisites are met. Effective risk management is imperative in the erratic cryptocurrency market, prices can alter in just a few minutes.

Are Crypto Trading Bots Legal?

Yes, bots that trade cryptocurrencies are legal, but the rules are different from country to country. Traders should follow local regulations and utilize trustworthy, transparent computers. It’s crucial to research the legal climate in your area and choose a bot that follows all of the relevant regulations.

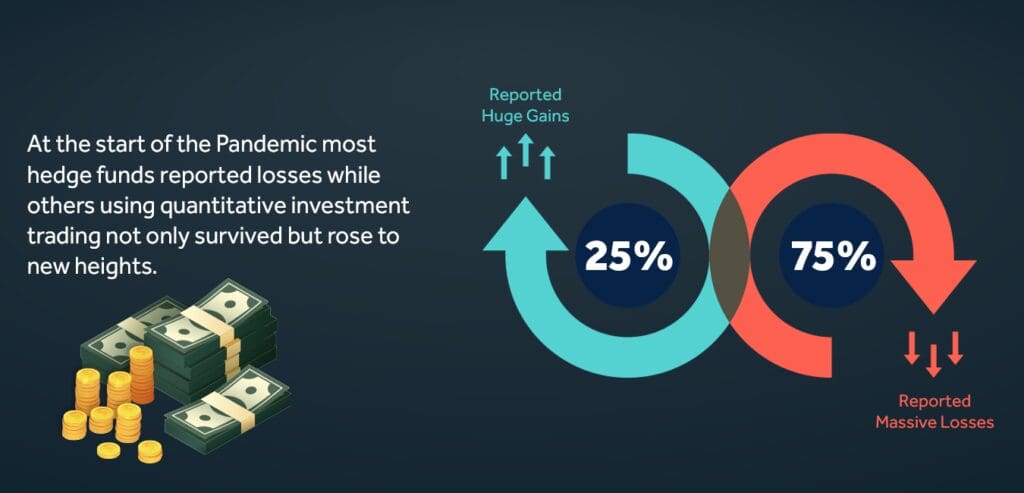

Is it profitable to trade with bots?

The revenue of bots that are profitable is dependent on multiple variables:

Strategy: A strategic approach to things increases profitability. Traders should assess their strategies using historical information in order to ensure their effectiveness before actually trading.

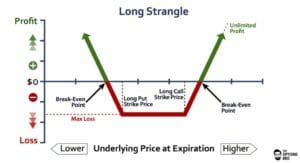

Market Conditions: Bots have a high degree of volatility, they capitalize on short term trends during rapid price changes.

Risk Management: Effective risk management is crucial. Establishing a stop-loss and take-profit level can prevent significant loss and preserve gain.

Bot quality: Select trustworthy bots that have a documented history of success. Look for bots that have been thoroughly tested and evaluated, which should produce the expected results.

Advantages

Constant Trading: Bots are always active, taking advantage of global markets and opportunities throughout the clock without humans needing to be aware of them.

Emotionless: Bots follow pre-established protocols, which eliminate the emotional component of trading, such as panic or greed, these protocols are strict and consistent.

Backtesting: Traders can assess their strategies using historical information before employing robots, improving the success of their algorithms.

Diversity: Bots have multiple cryptocurrencies under their control, which means that they spread the risk across different cryptocurrencies, and they also reduce the exposure to any single cryptocurrency.

Disadvantages

Technical Complexity: Establishing and configuring bots is complex, this is because of the need to understand programming and computational trading.

Market Vulnerabilities: Bots can’t anticipate abrupt shifts in the market or black swans that can lead to significant losses if not intended for these situations.

Dependence: Overreliance on automation can lead to missed opportunities. Traders must not rely on bots to conduct all of the trading activity, they must instead actively survey the market.

Price: Some bots have costs associated with them, or require subscriptions, and it’s important to consider these expenses against the potential profits.

Conclusion

Crypto-scripting bots facilitate ease and efficiency, but are not guaranteed to produce wealth. Traders should recognize their limitations and utilize them with caution. Implementing effective risk management and regularly surveying bots’ performance can lead to success. However, it’s essential to remember that no single strategy for trading is foolproof, and there is always a chance of loss in the erratic Cryptocurrency Market.