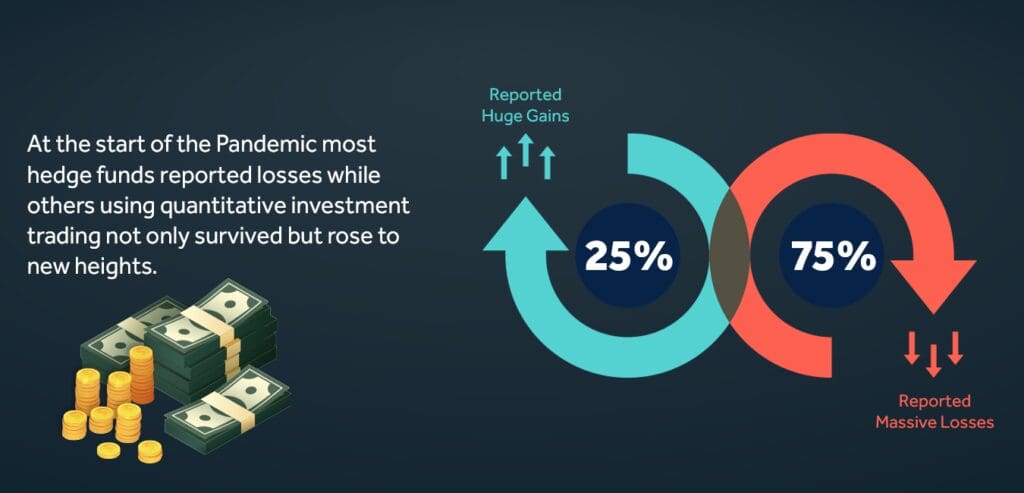

At the start of the pandemic, approximately 75% of hedge funds reported losses, while others rose to new heights, outperforming even their best years. What’s the difference, you might be asking?

One of the biggest factors in the success of investment funds boils down to the kind of business strategies used to make trading decisions with python for finance. Many of the companies that survived the uncertainties of 2020 were quantitative investment funds.

This notable difference between hedge fund business strategies can help businesses continue to navigate around uncertainties that jar the investment world, leading to spectacular performances of those funds.

What Is a Quantitative Investment Fund?

A quantitative investment fund is a hedge fund that uses algorithmic strategies to make decisions regarding trading. By using a combination of automatic computer algorithms and data science to execute python trading decisions, quantitative investment funds are driven by systemic strategies and trends.

Compare that to hedge funds that don’t use quantitative investment strategies. These “fundamental” investment funds might use data science to influence trading decisions, but, unlike quantitative python trading algorithm strategies, fundamental trading strategies are more subjective and prone to human error

Quantitative hedge funds use intelligent, mathematical models and principles to analyze dozens or even hundreds of different economic data factors. The automated computer technology allows quantitative investment funds to research and compares both long- and short-term scenarios, cross-sectional data, and other variables to make strategic decisions as free of human judgment as possible.

Quantitative Investment Funds Soaring to New Heights

Over the last few decades, hedge funds implementing quantitative analysis practices in their python stock trading decisions have risen to the forefront of the market.

Companies like DE Shaw, Renaissance, Two Sigma, Bridgewater, and more are just a few examples of algorithmic hedge funds that have significantly outperformed those using more traditional, fundamental analyses.

Take D.E. Shaw, for example for algo trading course. The New York-based company’s largest hedge fund increased by an astonishing 19.4% in 2020 alone, despite the financial uncertainty of the pandemic and election year. The hedge fund has invested approximately $55 billion in sheer assets. Since launching in 2001, D.E. Shaw hasn’t had a single down year, with an impressive annualized net return of 11.7%.

Likewise, the Medallion Fund is considered to be one of the leading hedge funds in the entire world, with a secretive group of scientists behind the spectacular performance of this quantitative investment fund. In the past three decades, the Medallion Fund has racked up over $100 billion in trading gains. What’s most notable about Medallion is that the hedge fund made these gains in less time than its competitors, with fewer assets. Like D.E. Shaw, the company has rarely seen a loss.

Behind almost every successful hedge fund is a methodical team of data scientists and analysts who know the power of using algorithmic trading with python to secure their spot at the top of the markets.

With what we know about these quantitative investment funds, it’s clear that quantitative investment techniques go hand-in-hand with top performances in the stocks.

Lumiwealth can help you get started with stock trading with python to remove the human guesswork from your trading decisions and increase your performance. Contact us today to get started mastering quantitative investments.