Introduction

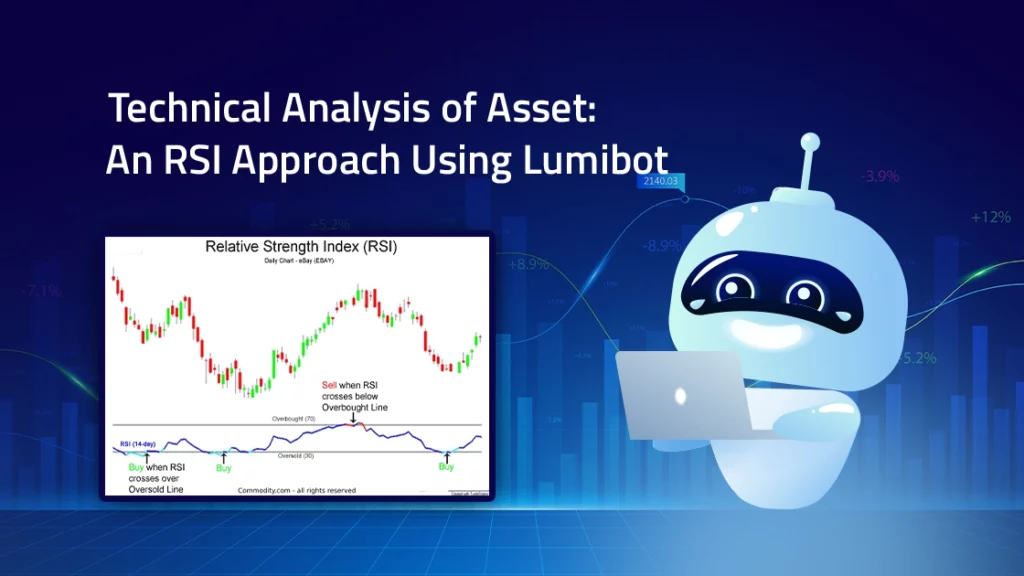

In the dynamic world of financial markets, where trends can shift rapidly, trading bots have become an invaluable tool for investors seeking to capitalize on opportunities. To create a truly effective trading bot, it’s essential to equip it with powerful analytical tools. One such tool is the Relative Strength Index (RSI), a popular technical indicator that measures the speed and change of price movements.

To incorporate RSI into your trading bot’s strategy, consider using a robust tool like Lumibot, a comprehensive Python library. Lumibot offers exceptional capabilities for retrieving historical price data, calculating technical indicators, and integrating them into your trading strategies. By leveraging Lumibot’s powerful features, you can build a smarter, more profitable trading bot that can effectively harness the insights provided by the RSI.

RSI: A Powerful Tool for Algorithmic Trading

The Relative Strength Index (RSI) is a versatile technical indicator that can be used to create various trading strategies. Here are five pointers on how to incorporate RSI into your trading bot:

1. Overbought and Oversold Signals:

- Identifying Extreme Conditions: When the RSI reaches extreme levels (e.g., above 70 or below 30), it might indicate an overbought or oversold condition.

- Trading Signals: Your trading bot can use these signals to initiate sell orders when the RSI is overbought and buy orders when the RSI is oversold. For instance, if the RSI reaches 80, the bot might automatically sell the asset, assuming it is overvalued.

2. Divergence:

- Identifying Divergence: Divergence occurs when the price and the RSI move in opposite directions. For example, if the price is making new highs, but the RSI is making new lows, it might suggest a potential reversal.

Trading Signals: Your trading bot can identify potential trend changes with divergence signals. For instance, if the price is making new highs, but the RSI fails to make new highs, it might indicate a bearish divergence, suggesting a potential downtrend.

3. Combining with Other Indicators:

- Enhanced Signal Reliability: Combining RSI with other technical indicators can help improve trading signals’ accuracy and reliability.

Example: Combining RSI with the Simple Moving Average (SMA) can provide a more comprehensive analysis. For instance, if the price is above the SMA and the RSI is near the overbought level, it might suggest a potential sell signal, indicating that the asset is overvalued and the uptrend might be nearing its end.

4. Backtesting:

- Evaluating Strategy Performance: Backtesting involves testing your trading strategy on historical data to assess its performance.

- Identifying Improvements: By backtesting, you can identify potential weaknesses in your strategy and make necessary adjustments.

Example: You can backtest an RSI-based trading strategy using historical data for a specific asset to determine its profitability and risk exposure.

5. Risk Management:

- Protecting Investments: Implementing risk management strategies is essential to protect your investments from excessive losses.

- Stop-Loss Orders: Set stop-loss orders to automatically sell the asset if the price is predetermined, limiting potential losses.

- Take-Profit Orders: Set take-profit orders to automatically sell the asset when it reaches a predetermined profit target, securing your gains.

- Position Sizing: Carefully manage your position size to avoid excessive risk. Consider factors such as your risk tolerance and the asset’s volatility.

By incorporating these pointers into your trading bot, you can effectively leverage the RSI to make informed trading decisions and improve investment outcomes.

Steps To Get the Relative Strength Index (RSI) of the Historical Price of an Asset with Lumibot

Prerequisites

Must have Python installed in the system(version 3.10 or above)

- Install required Python packages.

pip install lumibot

2. Necessary imports for running the Python file.

from lumibot.strategies import Strategy

import pandas_ta as ta

3. Create ALPACA_CONFIG with API KEY and API SECRET by logging in or signing up at https://alpaca.markets/

Steps for Using Relative Strength Index (RSI) of the Historical Price of an Asset

Step 1: Add ALPACA_CONFIG Details

Alpaca is a broker, just like the interactive broker. The details below are required to use the Alpaca broker API.

ALPACA_CONFIG = {

"API_KEY": "YOUR_API_KEY_HERE", # Get your API Key from

https://alpaca.markets/

"API_SECRET": "YOUR_SECRET_HERE", # Get your secret from

https://alpaca.markets/

"PAPER":True # Set to False for real money

}Step 2: Create a GetHistoricalPrice Class

Once you have added the Alpaca config detail, create a GetHistoricalPrice class, which will inherit the Strategy class as below.

class GetHistoricalPrice(Strategy):

Step 3: Add on_trading_iteration() Method

Once you have added the initialize method, follow with the creation of on_trading_iteration() method as below:

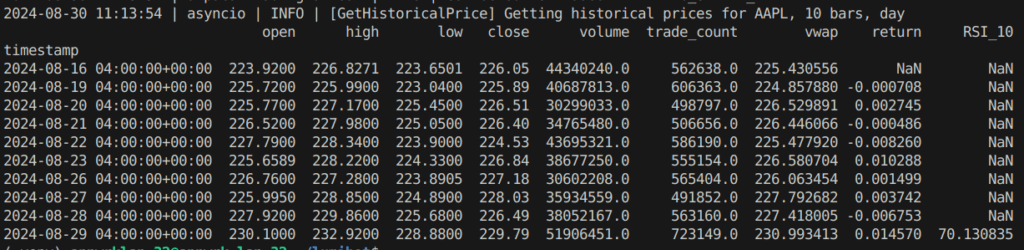

def on_trading_iteration(self):

# Retrieve historical price data for AAPL

bars = self.get_historical_prices("AAPL", 10, "day")

df = bars.df

df['RSI_10'] = ta.rsi(df['close'], length=9)

print(df)

The provided code snippet defines a function that retrieves historical price data for AAPL, calculates a 10-day Relative Strength Index (RSI), and prints the resulting data frame. This function could be used in various algorithmic trading scenarios, such as trend following, mean reversion, backtesting, or real-time trading. By incorporating this function into a larger trading system, you can leverage the power of technical analysis to make data-driven trading decisions.

Note 1: Running the Code in the Same File

In Python, if __name__ == “__main__”: is a conditional statement, which allows you to control the execution of code depending on whether the script is run directly or imported as a module. This implies that the code will run only if runs as a script and not as a module.

if __name__ == "__main__": Step 4: Import Alpaca and Trader

Import Alpaca and Trader classes from Lumibot.brokers and Lumibot.traders modules. While Alpaca is an interface to the Alpaca trading platform, it leverages us with the functionalities to interact with the Alpaca API for implementing things like placing orders, managing positions, and fetching market data like Historical Price Data, which we are doing in this blog.

The Trader class helps orchestrate the trading process, managing multiple trading strategies, interacting with brokers like Alpaca, Interactive Brokers, and Tradiers, handling order execution and position management, and ensuring a framework for live trading and backtesting.

from lumibot.brokers import Alpaca

from lumibot.traders import Trader

Step 5: Create Trader Class Object

As you import the Alpaca and Trader class, create the trader object of the Trader() class.

trader = Trader()

Step 6: Create an Object of Alpaca Class

On creation of the trader class object, create the object of the Alpaca class by passing the Alpaca_Config array created above.

broker = Alpaca(ALPACA_CONFIG)

Step 7: Create an Object of GetHistoricalPrice Class

Once we have created the object for the Alpaca class, we will create an object of the GetHistoricalPrice class by passing the Alpaca object (broker) as a parameter to the GetHistoricalPrice class.

strategy = GetHistoricalPrice(broker=broker)

Step 8: Pass the Strategy to the Trader Class Object

On creation of the object of the GetHistoricalPrice class, add the strategy to the trader class object using the add_strategy() method.

trader.add_strategy(strategy)

Step 9: Start the Overall Trading Process

The code below starts the overall trading process. This typically executes backtesting or a live trading process for a collection of strategies within a trading platform. This command starts the execution engine. It establishes the connection with a broker, which is Alpaca, and starts background tasks like market data ingestion and order management. Briefly, it is the starting point of the trading process.

trader.run_all()Complete Code

from lumibot.strategies import Strategy

import pandas_ta as ta

ALPACA_CONFIG = {

"API_KEY": "",

"API_SECRET": "",

"PAPER": True

}

class GetHistoricalPrice(Strategy):

def on_trading_iteration(self):

# Retrieve historical price data for AAPL

bars = self.get_historical_prices("AAPL", 10, "day")

df = bars.df

df['RSI_10'] = ta.rsi(df['close'], length=9)

print(df)

if __name__ == "__main__":

from lumibot.brokers import Alpaca

from lumibot.traders import Trader

trader = Trader()

broker = Alpaca(ALPACA_CONFIG)

strategy = GetHistoricalPrice(broker=broker)

trader.add_strategy(strategy)

trader.run_all()

Output

Conclusion

The Relative Strength Index (RSI) is a valuable technical indicator that can help you identify overbought or oversold conditions and potential trend reversals. By using Lumibot, you can easily retrieve historical price data, calculate RSI, and develop effective trading strategies. Combine RSI with other indicators and backtest your strategies to optimize their performance. Start your algorithmic trading journey today and unlock the power of RSI with Lumibot. By leveraging Lumibot’s features, you can streamline the process of using RSI in your trading strategies and make data-driven investment decisions.