In the ever-evolving world of finance, staying ahead of the game is crucial for success. The realm of options trading is no exception, and harnessing the power of cutting-edge algorithms has become the ultimate weapon for savvy traders. Imagine revolutionizing your options trading strategy by leveraging these advanced algorithms that are designed to optimize your decision-making process, minimize risks, and maximize profits. Gone are the days of relying on intuition and guesswork; the future of options trading lies in the seamless integration of technology and human expertise. Read on to discover how these groundbreaking algorithms can unlock your true potential as an options trader, and propel you into a new echelon of financial success. The time has come to embrace the future and transform your options trading strategy with the precision and prowess that only cutting-edge algorithms can provide.

The Importance of Algorithmic Trading in Options

The world of finance is constantly evolving, and the rise of algorithmic trading has been a game-changer for options traders. Algorithmic trading involves the use of complex mathematical formulas and computer programs to make trading decisions, based on historical price data and market trends. This approach to trading has gained significant traction in recent years, as it allows traders to make more precise and well-informed decisions, leading to potentially higher profits and reduced risk.

Options trading, in particular, can greatly benefit from algorithmic strategies. The inherent complexity of options, with their numerous variables and potential strategies, makes them an ideal candidate for algorithmic trading. By incorporating algorithms into their trading strategies, options traders can better identify optimal entry and exit points, manage risk, and maximize returns. This technological innovation has leveled the playing field for all traders, from individual investors to large institutions, allowing everyone to take advantage of these advanced tools.

Furthermore, algorithmic trading has the potential to eliminate some of the emotional biases that often plague human decision-making in financial markets. By automating the trading process, algorithms can execute trades based on a predefined set of rules, without being influenced by fear or greed. This can lead to more consistent and objective trading strategies, ultimately allowing traders to improve their overall performance and achieve greater success in the options market.

Key Components of an Algorithmic Options Trading Strategy

Before diving into the world of algorithmic options trading, it’s important to understand the key components that make up a successful strategy. These components will serve as the foundation for your algorithm and will ultimately determine its effectiveness in helping you achieve your trading goals.

1. Market data: A robust algorithmic trading strategy relies on accurate and timely market data. This includes historical price data, as well as real-time information on market trends and volatility. By incorporating this data into your algorithm, you can better identify trading opportunities and make more informed decisions.

2. Technical indicators: Technical indicators are mathematical calculations based on historical price data that can help traders identify trends, patterns, and potential entry and exit points. Some popular technical indicators used in algorithmic options trading include moving averages, Bollinger Bands, and the Relative Strength Index (RSI). Combining multiple technical indicators can help to create a more comprehensive trading strategy.

3. Risk management: Effective risk management is crucial for any trading strategy, and algorithmic options trading is no exception. Incorporating risk management techniques into your algorithm, such as position sizing and stop-loss orders, can help to minimize losses and protect your trading capital.

4. Trading rules: At the core of any algorithmic trading strategy are the trading rules that dictate when to enter and exit a position. These rules should be based on a combination of market data, technical indicators, and risk management techniques. By crafting a set of clear and concise trading rules, you can ensure that your algorithm operates in a consistent and objective manner.

5. Backtesting and optimization: Once you have developed your algorithmic trading strategy, it’s essential to test and optimize its performance using historical data. This process, known as backtesting, allows you to evaluate the effectiveness of your strategy and make any necessary adjustments before deploying it in the live market.

Building a Powerful Options Trading Algorithm

Creating a powerful options trading algorithm starts with defining your trading objective and identifying the key components that will support your strategy. Begin by outlining your goals, such as generating consistent profits, minimizing risk, or capitalizing on specific market opportunities. This will serve as the guiding principle for your algorithm and will help you select the appropriate market data, technical indicators, and risk management techniques.

Next, you’ll need to develop a set of trading rules based on your chosen components. These rules should dictate when to enter and exit a position, as well as any risk management measures that will be employed. Be sure to consider the intricacies of options trading, such as strike prices, expiration dates, and implied volatility, when crafting your trading rules.

Once you have established your trading rules, you can begin to build your algorithm using a programming language and software platform of your choice. Some popular options include Python, R, and MATLAB, as well as specialized algorithmic trading platforms such as QuantConnect and AlgoTrader. Keep in mind that the quality of your algorithm will largely depend on your programming skills and familiarity with the chosen language and platform.

Backtesting and Optimizing Your Algorithmic Strategy

Before deploying your algorithmic options trading strategy in the live market, it’s essential to thoroughly test and optimize its performance using historical data. This process, known as backtesting, allows you to evaluate the effectiveness of your strategy and identify any potential weaknesses or areas for improvement.

Backtesting involves running your algorithm against historical price data to simulate its performance under various market conditions. This can help you determine how well your strategy would have performed in the past, providing valuable insights into its potential future performance. Be sure to use a representative dataset that covers a wide range of market conditions, including periods of both high and low volatility.

Once you have completed the backtesting process, you can use the results to refine and optimize your algorithmic strategy. This may involve adjusting your trading rules, incorporating additional technical indicators, or modifying your risk management techniques. The goal is to create a well-rounded strategy that is capable of navigating various market conditions and delivering consistent results.

Risk Management in Algorithmic Options Trading

Effective risk management is crucial for any trading strategy, and algorithmic options trading is no exception. By incorporating risk management techniques into your algorithm, you can protect your trading capital and minimize losses, ultimately improving your overall performance and profitability.

Some key risk management techniques to consider when developing your algorithmic options trading strategy include:

1. Position sizing: Limiting the size of your positions can help to reduce the impact of any single trade on your overall portfolio. This can be particularly important in options trading, where the potential for large losses can be significant. By incorporating position sizing rules into your algorithm, you can ensure that your exposure is kept within acceptable limits.

2. Stop-loss orders: Stop-loss orders are a common risk management tool that can be used to automatically exit a losing trade once it reaches a predetermined level of loss. By incorporating stop-loss rules into your algorithm, you can help to limit your downside risk and protect your trading capital.

3. Diversification: Diversifying your trading portfolio can help to spread risk across a range of assets and strategies, reducing the likelihood of large losses. In algorithmic options trading, this might involve trading multiple options contracts, employing a variety of strategies, or even incorporating other asset classes into your portfolio.

4. Monitoring and adjustments: Even the most well-designed algorithmic trading strategy can encounter unexpected challenges in the live market. Regularly monitoring your algorithm’s performance and making necessary adjustments can help to mitigate risk and ensure that your strategy remains effective in changing market conditions.

Popular Algorithmic Options Trading Platforms

There are several platforms available for traders looking to develop and deploy algorithmic options trading strategies. Some popular options include:

1. QuantConnect: QuantConnect is a cloud-based algorithmic trading platform that supports a wide range of asset classes, including options. The platform offers a comprehensive library of historical data, as well as a user-friendly interface for developing and backtesting algorithms. QuantConnect also supports multiple programming languages, including C#, Python, and F#.

2. AlgoTrader: AlgoTrader is an institutional-grade algorithmic trading platform designed for quantitative trading firms and sophisticated individual traders. The platform supports options trading and provides a wide range of features, including historical data, backtesting capabilities, and integration with popular trading platforms such as Interactive Brokers and Tradestation.

3. TradeStation: TradeStation is a popular trading platform that offers a suite of tools for algorithmic trading, including options. The platform’s EasyLanguage programming language allows users to create custom trading algorithms and backtest them using historical data. TradeStation also offers integration with other platforms, such as AlgoTrader, for more advanced algorithmic trading capabilities.

4. NinjaTrader: NinjaTrader is a powerful trading platform that supports algorithmic trading, including options. The platform offers a range of features designed for options traders, such as advanced charting, strategy development tools, and historical data for backtesting. NinjaTrader’s C#-based programming language, NinjaScript, allows users to create custom trading algorithms and deploy them in the live market.

Combining Traditional Options Strategies with Algorithms

One of the most effective ways to revolutionize your options trading strategy with algorithms is to combine traditional options strategies with algorithmic techniques. This approach can help you capitalize on the strengths of both methods, leading to more consistent and profitable trading results.

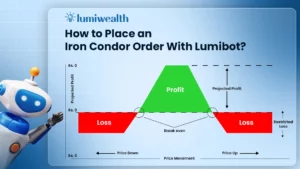

For example, you might employ a traditional options strategy, such as a covered call or iron condor, while using an algorithm to identify optimal entry and exit points based on technical indicators and market data. Alternatively, you could use an algorithm to dynamically adjust your position sizing or manage risk throughout the life of a trade.

By combining the proven effectiveness of traditional options strategies with the precision and objectivity of algorithmic trading, you can create a powerful hybrid approach that leverages the best of both worlds. This can help you unlock your true potential as an options trader and achieve greater success in the market.

Real-Life Examples of Successful Algorithmic Options Trading

The success of algorithmic options trading can be seen in the performance of some well-known hedge funds and individual traders. For instance, Citadel, a leading global asset manager, uses sophisticated algorithms to trade options and other financial instruments, generating consistent profits for its investors. Similarly, many individual traders have found success by incorporating algorithmic techniques into their options trading strategies.

One notable example is Karen Bruton, also known as “Karen the Supertrader,” who reportedly generated millions in profits through algorithmic options trading. Karen’s strategy involved selling out-of-the-money options and managing risk through meticulous position sizing and diversification. By leveraging the power of algorithms, she was able to achieve remarkable success in the options market.

These real-life examples demonstrate the potential of algorithmic options trading and serve as inspiration for traders looking to revolutionize their own strategies.

Conclusion and Next Steps in Revolutionizing Your Options Trading Strategy

In conclusion, algorithmic options trading offers a powerful and effective way to revolutionize your trading strategy. By incorporating cutting-edge algorithms into your approach, you can optimize your decision-making process, minimize risks, and maximize profits. The key is to combine the best aspects of traditional options strategies with the precision and objectivity of algorithmic techniques, creating a hybrid approach that can deliver consistent results in the options market.

To get started with algorithmic options trading, consider the following steps:

- Define your trading objectives and identify the key components of your strategy, such as market data, technical indicators, and risk management techniques.

- Develop a set of trading rules based on your chosen components and create an algorithm using a programming language and platform of your choice.

- Backtest and optimize your algorithmic strategy using historical data to ensure its effectiveness in the live market.

- Implement your algorithmic options trading strategy in the live market, using a suitable trading platform and brokerage account.

- Monitor and adjust your algorithm’s performance as needed to ensure its continued success in changing market conditions.

By following these steps, you can unlock your true potential as an options trader and propel yourself into a new echelon of financial success. Embrace the future of options trading and transform your strategy with the precision and prowess that only cutting-edge algorithms can provide.