Ok, let’s start with the numbers:

Ken Griffin’s fund returned 38% in 2022, helping Citadel generate a net gain of $16 billion last year.

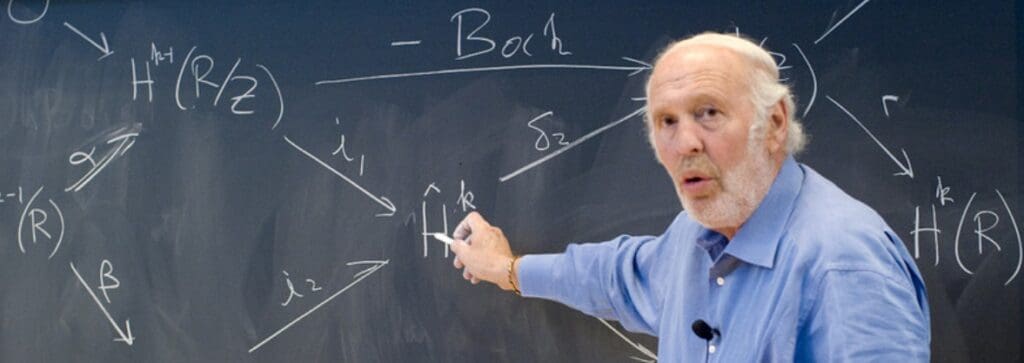

Ray Dalio posted a 32% return through the first half of 2022, while Jim Simons has maintained a 66% average return for over 30 years!

Have you ever wondered how some of the world’s top investors consistently outperform the market year after year?

The answer may surprise you – algorithms.

The Power of Algorithms

Investors such as Ray Dalio, Ken Griffin, and Jim Simons publicly admit that they use algorithms to guide their investment decisions, resulting in significantly higher returns than the overall market.

Algorithmic trading (or algo trading) is the use of advanced computer programs to make investment decisions by analyzing vast amounts of data to identify patterns and trends.

But why is algorithmic trading so powerful?

One reason is that algorithms can analyze data at a speed and scale that humans simply cannot match. They can quickly process information from a wide range of sources and identify profitable trading opportunities that may be overlooked by human traders.

Additionally, algorithms can operate 24/7, allowing for trades to be executed at any time of the day or night, taking advantage of small market movements around the clock.

But contrary to what many people think, the algorithms don’t do it all themselves – a human needs to decide on the strategy and the parameters, and the algorithm will simply execute that strategy at the speed of light.

So credit is due to Ray Dalio, Ken Griffin and Jim Simons for coming up with winning strategies and then building algorithms that can implement those strategies in the markets.

How do Ray Dalio, Ken Griffin and Jim Simons use algorithms?

One of Ray Dalio’s funds, Pure Alpha, makes directional bets on various markets including stocks, bonds, commodities and currencies by predicting macroeconomic trends with the help of computer models.

The fund has long anticipated booms and busts around the world, including the looming financial crisis as early as 2006.

Similarly, Ken Griffin employs smart mathematicians and scientists at Citadel who harness cutting-edge technology—predictive analytics, machine learning and artificial intelligence—to analyze huge amounts of data in real time that then fuel their decision-making processes.

Jim Simons, founder of Renaissance Technologies and a mathematician himself, built an investment strategy based on identifying and finding patterns in the market, i.e. movements that repeat over time, so that they become predictable. Once they are identified, their level of reliability is tested through algorithms in so-called backtesting.

To build such a model, Simons compiled data from the historical records of the World Bank and the Federal Reserve since the 1700s, thus succeeding in unveiling the underlying logic of the operations

Those examples should help you understand how algorithms can be incredibly powerful if fed with huge amounts of data and guided by solid strategies.

How YOU Can Use Algorithms to Improve Your Returns

The good news is that you don’t have to be a multi-billionaire hedge fund manager to benefit from algorithmic trading.

In fact, anyone can learn the basics of Algorithmic Trading and build their own trading bot, even if they have no coding experience. That’s why we’re excited to offer a free introductory class on Algorithmic Trading for Beginners.

> CLICK HERE TO WATCH THE FREE WEBINAR

In this class, you’ll learn the basics of algorithmic trading and discover how you can use it to your advantage. You’ll learn how to analyze data, identify profitable trading opportunities, and execute trades quickly and efficiently. And best of all, you’ll be able to build your own trading bot even if you’ve never coded before.

Our introductory class is designed to be beginner-friendly, and you’ll even learn the basics of Python, one of the most popular programming languages used in algorithmic trading. Don’t be discouraged if you have no coding experience, we guarantee you’ll be able to follow along and build your own trading bot!

So, if you want to start using algorithms like Ray Dalio, Ken Griffin, and Jim Simons, sign up for our free class on Algorithmic Trading for Beginners today.

Don’t miss this opportunity to learn from the experts and take your trading game to the next level.

> CLICK HERE TO WATCH THE FREE WEBINAR