Are you interested in learning about algorithmic trading using Python? For novice traders and those entering the finance industry with a career, a solid knowledge of algo trading and market technology can greatly benefit you.

In this guide, we’ll break down the basics of algorithmic trading and how to get started. We’ll also talk a bit about our algo trading courses and how Lumiwealth can help you learn how to code and engage in algorithmic trading quickly.

How to Get Started with Algorithmic Trading

What is Lumiwealth?

Lumiwealth is an algorithmic trading platform and instruction provider. We understand how important it is to be able to invest using technology, as the world of trading is constantly evolving. We offer a wide range of courses on algorithmic trading that are lead by experienced instructors.

Our goal is to help traders and investors take control of their personal financial health. If you want to become an expert in the finance field, we believe that a solid knowledge of algorithmic trading can make the biggest difference.

We’re proud to offer an algorithmic trading course, a machine learning for trading course, and many other workshops dedicated to the art of trading with algorithms and code. Stick around until the end of this guide to learn more about the courses we offer.

Now, let’s get into what exactly algorithmic trading actually is.

The Basics of Algorithmic Trading

Algorithmic trading is an investment methodology that uses data science as well as automated executions to build instructions for trading. Algo trading is different from traditional trading techniques because it takes out the need for human predictions and the risk of error that comes along with it. With algorithmic trading, one can use techniques based on data science to successfully trade, such as financial fundamentals and economic data collection.

Trading can be a very emotional process. In fact, you’ve likely heard of courses dedicated to helping day traders get a grip on their emotions to keep them from making impulsive mistakes. With algorithmic trading, there’s no need for the human side of trading– you can essentially sit back and let the code do the work for you. With algorithmic trading, we’re using software to analyze data and make trades in an automated way.

So why algorithmic trading? Why do we care? Why does it matter?

It’s worth noting that algorithmic trading doesn’t have to be the “right” way to trade. At Lumiwealth, our goal is to help data-focused people use their skills to automate their trading practices. Algo trading is great, but it might not be the right way for you to make money. In our opinion, anyone who tries to convince you that there’s only one way to trade is simply wrong.

What we’re all about is the data. That’s the core of algorithmic trading– we’re downloading data, back-testing it, and trying new strategies. Data analysis is the backbone of excellent trading strategies because it uses proof and data science to provide insight into good trading choices. Algo trading is about building new ways to analyze and understand the right trading practices.

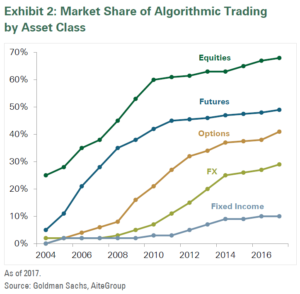

To really understand algorithmic trading, some coding knowledge is important. It’s a common misconception that algo trading is all about trading hundreds of times a day and that it is no different than trading in the traditional sense. In fact, you’ve probably already used algo trading without knowing it – many financial institutions already use this technology in ETFs, market making, and more. Rather than human guesswork, algo trading utilizes data to make smart decisions. Similar to trading signals, algo trading takes things a step further and fully automates the process. You can also set up your algorithm to simply notify you of changes in the market so you can take care of the buying and selling on your own.

Essentially, algo trading allows you to take control of your investments to an entirely new level, and Python is a great language to do this with.

Here’s how it works: Your algorithm will identify changing trends in the market. Let’s say that Walmart is getting more foot traffic. It’s very likely that more people are buying from Walmart, and thus Walmart will be more profitable. Your algorithm can notify you of this uptick in traffic and break down why you should invest now rather than later, or sell now. Your algorithm can handle the trading for you or simply inform you of market changes so you can make more informed decisions.

Algorithmic trading offers a ton of benefits to traders. You’ll be able to back-test your strategies or use code that has already been back-tested, so there’s no guesswork involved in your trading strategies. You’ll be able to see patterns in earlier back-tests that can help you figure out what will work and what won’t. Your strategies won’t be sullied by panicked human decisions, as it takes the emotion out of the equation. You’ll also have more time to make better investment strategies. It’s a lot easier to monitor your algorithms instead of studying the market, so you’ll have the time to branch out to other markets. The result is significantly less risk for your investments.

Algorithmic trading has been used by some of the richest people on the planet. People like Jeff Bezos, Elon Musk, and most of the people at the top of the Forbes list have used software and financial technology to accrue wealth. Clearly, there’s some merit to it. However, if you enter algorithmic trading without any knowledge of data science or coding knowledge, you could possibly lose money. That’s why it’s so vital to take algorithmic trading courses to educate yourself and start algorithmic trading quickly.

Learn Algorithmic Trading the Right Way with Lumiwealth

The world of trading is constantly changing and evolving. Being able to keep up is becoming more and more difficult. That’s why Lumiwealth is offering algorithmic trading workshops to help traders take advantage of algorithmic trading methodologies. We want to contribute to the community by providing a library full of videos and code to help you grasp the technical aspects of algorithmic trading.

We offer several different types of plans to suit your unique needs. Our self-directed plan provides access to our massive collection of instruction videos and sample code, so you can learn and work at your own pace. Our live classes plan puts you in front of an experienced instructor at pre-scheduled times, so you can interact with other peers in the group as well as your instructor. Our project help or tutoring plan is a more personalized version of our live classes plan, where you will meet via video conference with an experienced instructor to ensure you are grasping concepts and building your custom portfolio project the right way.

Our courses will teach you how to analyze your investments the smart way, make good decisions using proven data, and build back-testing strategies. We’ll also help you understand how to code, automate your trades, and calculate risks more efficiently. You might be surprised by how quickly you’ll go from novice to algo trading expert!

Regardless of your choice, you’ll be able to access hours of video, tons of code, new future videos, and the Lumiwealth Discord community. Take a look at our Algorithmic Trading Using Python Course page to learn more and sign up.