Did you know that only one out of every five day-traders actually makes a profit? The ever-changing world of trading can be challenging to navigate. In fact, most trading on the stock market is performed by robots, making it like playing a rigged game of chess, where your chances of winning are stacked against you.

That’s why many day-traders have started to learn algorithmic trading to improve their odds of making money through trading.

In this post, we discuss just exactly how algo trading using python works and how you can create an algorithmic trading robot to help increase your odds of becoming the next, big money trader.

What Is Algorithmic Trading?

Algorithmic trading uses data science and computer-automated executions, rather than human guesswork, to create instructions for trading. Since trading activities use data science techniques like technical indicators, financial fundamentals, and economic data, this also eliminates human emotions that can interfere with the success of trading.

How Can Algorithmic Trading Benefit Traders?

Algorithm trading offers numerous benefits for traders. Once you make the switch, you’ll likely be surprised that you hadn’t been incorporating algorithmic trading strategies into your investments all along.

Here are just a few key benefits that ultimately save you time and money.

Your Trading Strategies Are Back-tested

Algorithmic trading takes the guesswork out of your trading strategies. By reviewing past back-tests, you can more clearly see patterns, which in turn helps you figure out what’s working and what isn’t working.

Your Strategies Are Less Prone to Human Error

We all know just how fallible human calculations can be, and no one wants to make grave errors when it comes to their investments. That’s where algorithmic trading can be immensely beneficial for your financial trades.

Since algorithmic trading strategies are executed by computer software, there’s less room for error. This means that you can steer clear of common mistakes that you would otherwise make.

You Have More Time to Develop Your Strategies

While computers do make mistakes, it’s far easier to monitor and troubleshoot, saving you time and money on your investment strategies and other areas that are in need of your attention.

This means you can more easily branch out to other trade markets and strategies, allowing you to have less of a risk per capita of trade investments. In other words, you’re not putting all of your eggs in one investment basket.

Where Can I Learn More?

Are you ready to step up your day trading game? Though learn algorithmic trading may sound like the ultimate secret to your trading success, knowing exactly how to navigate a new arena of the data science world is no easy feat. In fact, if you don’t know what you’re doing, you could actually lose money.

That’s why we have created an algorithmic trading course to help you navigate Python software and start utilizing all that algorithmic trading has to offer & help you develop trading algorithms.

In this course, you will learn the ins and outs of Python trading, where you can:

- Analyze your investments

- Make better decisions about your investments using data

- Implement back-testing strategies

- Automate your trades

- Calculate the risks and potential returns on investments

- And, most importantly, start making money from those investments

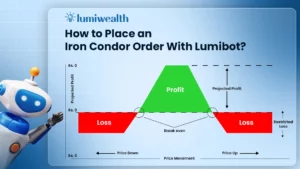

We also have an open-sourced project, called Lumibot, that you can use to access what we use in our classes. This project is free for the public and can provide you with many resources to support your algorithmic trading journey and help you with coding trading bots yourself.

If you’re ready to get started, sign up for our free live class, where you can download the course information on how to become the next, big algorithmic trader.

FAQ

What is algorithmic trading?

Algorithmic trading is when software code (eg. Python) is used to automatically buy and sell securities (eg. AAPL stock). In other words, it is a robot that can automatically buy and sell stocks, options, futures, and more for you.

How do I get started with algorithmic trading?

To build an algorithmic trading robot you will usually have to first learn a software coding language such as Python, then use a library such as lumibot to connect to a broker and execute trades.

What is backtesting?

Backtesting is the process of creating a trading strategy, then using data from the past to see how the strategy would have performed in the past. This could be very valuable to see whether your algorithm will perform well in the future.

Where can I learn algorithmic trading?

Since there are many potential pitfalls (ways to lose money), the best way to learn algorithmic trading is by taking a course on the topic. At Lumiwealth we have several courses on algorithmic trading that have gotten great reviews.