If you’re looking to get the most out of your investment decisions and maximize your profits, then backtesting is the tool you need. Backtesting is a powerful tool that allows you to test your trading strategies in a simulated environment. By backtesting a trading strategy, you can find out if it’s viable or not and make necessary adjustments before you start trading with real money. In this article, we’ll be discussing what backtesting is, the benefits of backtesting, and how to backtest a trading strategy.

What is Backtesting?

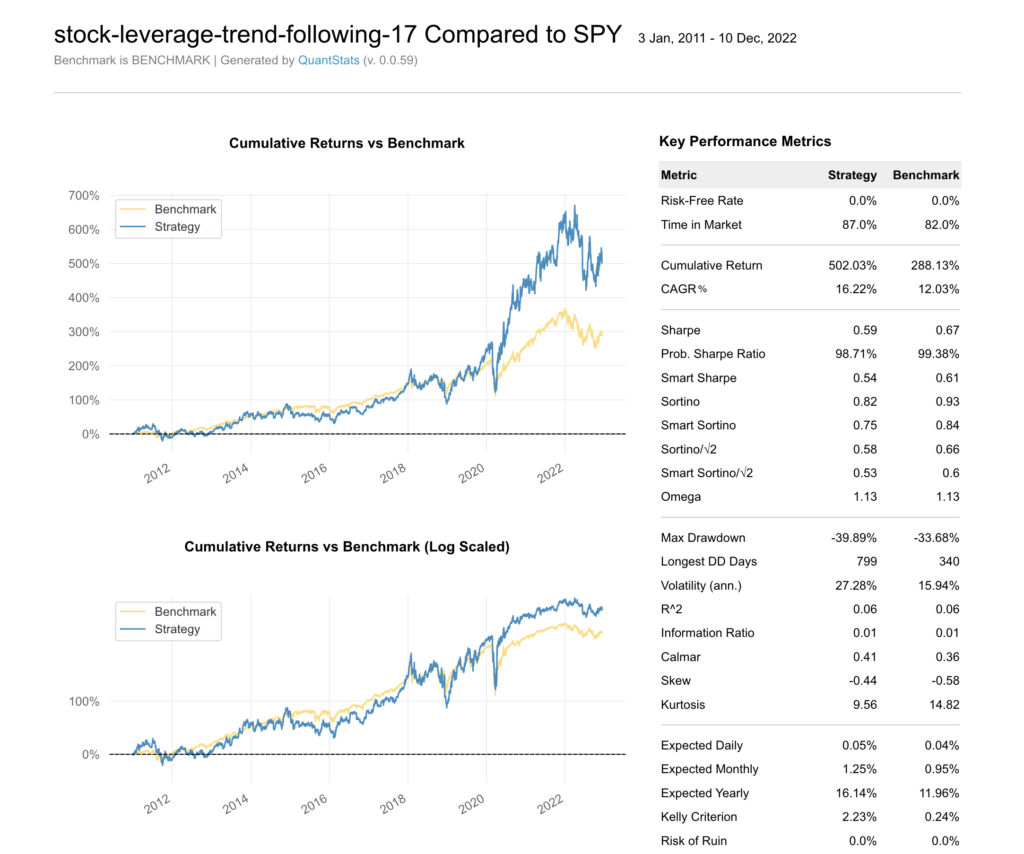

Backtesting is the process of testing a trading strategy against historical data to evaluate its performance. It’s a great way to get a better understanding of how a trading strategy would have performed in the past and identify any potential flaws. By backtesting a trading strategy, you can determine whether it’s worth pursuing or not. This can help you make more informed decisions and maximize your profits.

Backtesting is commonly used by traders and investors to determine the viability of a trading strategy. It can provide insights into the potential returns, risk, and other performance metrics of a trading strategy. Furthermore, backtesting can help you identify trading opportunities and develop strategies to capitalize on them.

What are the Benefits of Backtesting?

Backtesting can provide numerous benefits for traders and investors. Firstly, it can help you identify potential trading opportunities. By backtesting a trading strategy, you can determine how it would have performed in the past and identify any potential flaws. This can help you make more informed decisions and maximize your profits.

Secondly, backtesting can help you develop more robust trading strategies. By testing a trading strategy against historical data, you can identify any weaknesses and make necessary adjustments to improve the strategy. This can help you develop more robust trading strategies that are better suited to the current market conditions.

Finally, backtesting can help you reduce your risk. By backtesting a trading strategy, you can identify any potential flaws that could lead to losses. This can help you reduce your risk and ensure that your trading strategies are sound.

How to Backtest a Trading Strategy

Backtesting a trading strategy is relatively straightforward. First, you need to identify a trading strategy that you want to test. Then, you need to collect historical data for the assets you want to trade. Next, you need to input the data into a backtesting platform. Finally, you can analyze the results of your backtesting and make necessary adjustments.

The most important part of backtesting is collecting the right data. You need to ensure that you have enough historical data to accurately test your trading strategy. This typically means having at least a few years worth of data. Additionally, you need to make sure that the data is accurate and up-to-date.

Once you have the data, you need to input it into a backtesting platform. Most online brokers have backtesting platforms that you can use. These platforms typically have user-friendly interfaces that make it easy to input the data and analyze the results.

Once the backtesting is complete, you need to analyze the results. You can use the backtesting results to determine the potential returns and risks of a trading strategy. Additionally, you can use the results to identify any potential flaws and make necessary adjustments.

What Techniques to Use for Backtesting

Once you have the data, you need to decide which technique to use for backtesting. The most common backtesting technique is Monte Carlo simulation. This technique involves randomly sampling historical data to simulate a trading strategy. This can help you identify any potential flaws in the trading strategy and make necessary adjustments.

Another technique that you can use is Walk Forward Analysis. This technique involves testing a trading strategy over a period of time and gradually increasing the sample size. This can help you identify any potential flaws in the trading strategy and make necessary adjustments.

Finally, you can use Machine Learning techniques for backtesting. These techniques involve using algorithms to analyze the historical data and identify potential trading opportunities. Machine Learning techniques can help you identify profitable trading strategies and make more informed decisions.

Portfolio Backtesting

Portfolio backtesting is a powerful tool that can help you identify potential trading opportunities and develop robust trading strategies. This technique involves testing a portfolio of assets against historical data to determine the potential returns and risks. This can help you identify any potential flaws in the portfolio and make necessary adjustments.

Portfolio backtesting can help you identify correlations between different assets and develop diversified portfolios. Additionally, it can help you identify trading opportunities and develop strategies to capitalize on them.

Backtesting Stocks

Backtesting stocks is a great way to identify potential trading opportunities and make more informed decisions. This technique involves testing a stock’s performance against historical data to determine the potential returns and risks. This can help you identify any potential flaws in a stock’s performance and make necessary adjustments.

Backtesting stocks can help you identify profitable trading opportunities and develop robust strategies. Additionally, it can help you identify correlations between different stocks and develop diversified portfolios.

Backtesting Strategies

Backtesting strategies can help you identify potential trading opportunities and develop robust strategies. This technique involves testing a trading strategy against historical data to determine the potential returns and risks. This can help you identify any potential flaws in the strategy and make necessary adjustments.

Backtesting strategies can help you identify profitable trading opportunities and develop robust strategies. Additionally, it can help you identify correlations between different strategies and develop diversified portfolios.

Backtest Stock Strategies

Backtest stock strategies is a great way to identify potential trading opportunities and make more informed decisions. This technique involves testing a stock strategy against historical data to determine the potential returns and risks. This can help you identify any potential flaws in the strategy and make necessary adjustments.

Backtest stock strategies can help you identify profitable trading opportunities and develop robust strategies. Additionally, it can help you identify correlations between different stocks and develop diversified portfolios.

Software for Backtesting

There are many software tools available for backtesting your trading strategies. These tools typically have user-friendly interfaces that make it easy to input the data and analyze the results. Additionally, they often have advanced features that can help you identify potential trading opportunities and develop robust strategies.

Some of the most popular backtesting software tools include TradingView, QuantConnect, and TradeStation. These tools provide powerful backtesting capabilities and can help you identify profitable trading opportunities and develop robust strategies.

Conclusion

Backtesting is a powerful tool that can help you get the most out of your investment decisions and maximize your profits. By backtesting a trading strategy, you can determine whether it’s worth pursuing or not and make necessary adjustments before you start trading with real money. Additionally, backtesting can help you identify potential trading opportunities and develop robust strategies to capitalize on them. Click here to sign up for our free trial today and learn how to create your own trading robot using python!